The last two decades have seen a dramatic migration of US and global equity investors toward passive approaches, especially in large-cap stocks. Passive investing may be cheaper on the surface, but we think investors are taking on more risk than they know. We think it makes sense to combine passive strategies with highly concentrated strategies.

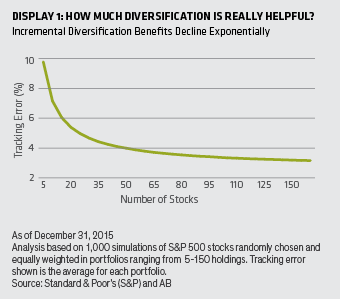

But it’s fair to ask pointed questions about how the two approaches stack up. It’s a common assumption that the more stocks you add to an equity portfolio, the more it reduces volatility. But beyond a threshold of 20 to 30 stocks, it gets more challenging to meaningfully reduce tracking error. This leaves a strong case to be made for quality of stocks, not quantity, in portfolio construction. By using research to focus on fewer but higher-quality stocks, concentrated investing has the potential to produce substantial alpha through security selection.

Our research shows that “concentrated” active managers have been very successful in terms of excess returns and risk-adjusted returns as well as downside risk reduction. Concentrated investing may also be an effective complement to passive investing.