- OVERVIEW

- INTEGRATION & ENGAGEMENT

- SOLUTIONS

- REPORTING & STATEMENTS

- DATA DISCLOSURES

The Critical Role of Responsibility

At AB, we’re invested in being a responsible firm—both in how we act and how we invest on behalf of our clients. We believe that research, engagement and integration of material ESG issues can help us better assess risks and identify opportunities, ultimately leading to enhanced decision-making and better client outcomes.

The industry expertise of our investment team is important to developing an understanding of material ESG issues. Moreover, AB’s Responsibility team complements the investment teams’ research and engagement efforts. The Responsibility team members have domain expertise in E, S and G issues, which can be used to challenge the investment teams’ thinking and equip our fundamental analysts with tools and training to consider material ESG issues, where applicable.

Responsibility Is Embedded Throughout the Firm

AB’s Responsibility team, comprising experts in corporate responsibility and environmental, social and governance issues, partners with our investment teams at the heart of our responsible investing practices. Their work is supported by internal and external resources, and overseen by our Responsibility Steering Committee and AB’s Board of Directors.

Proxy Voting

To be effective stewards of our clients' investments and maximize shareholder value, we need to vote proxies on behalf of our clients responsibly. As a research-driven firm, we approach our proxy-voting responsibilities with the same commitment to rigorous research and engagement that we apply to all our investment activities.

History of Our Commitment

Why Investment Teams Need to Lead the Way

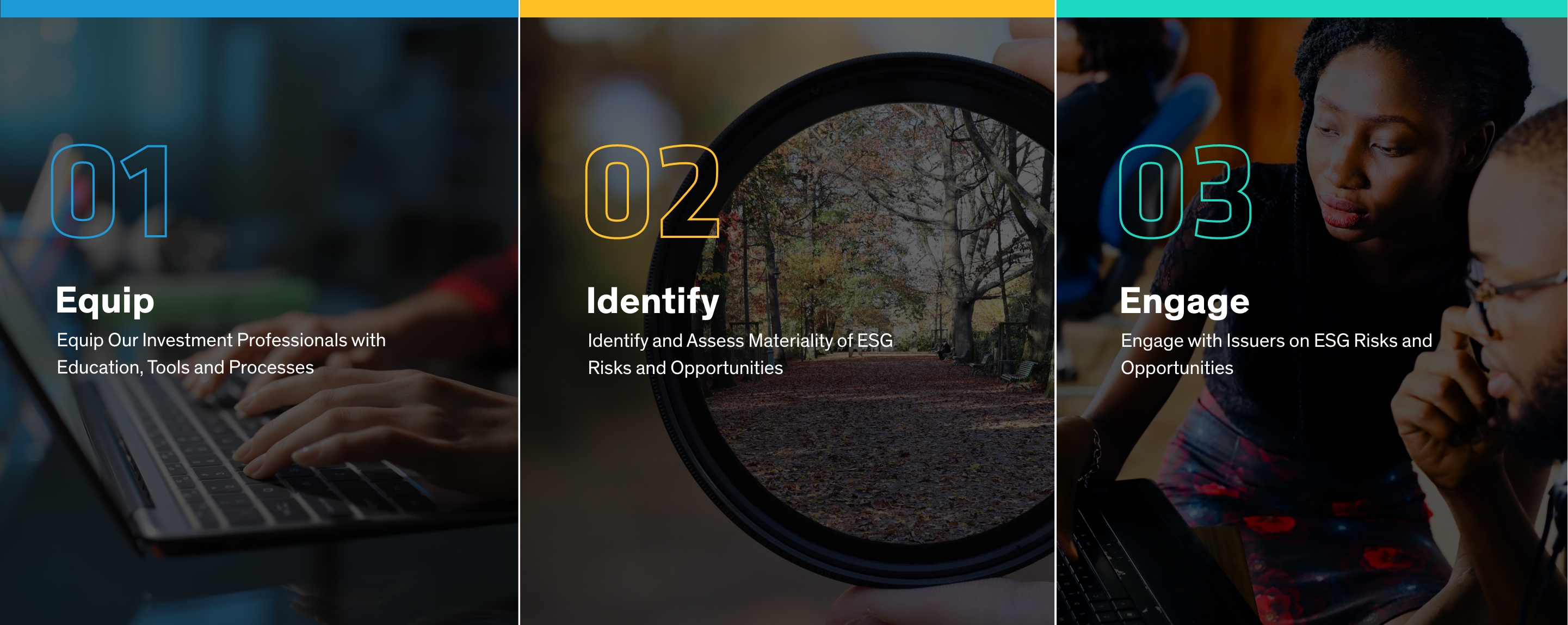

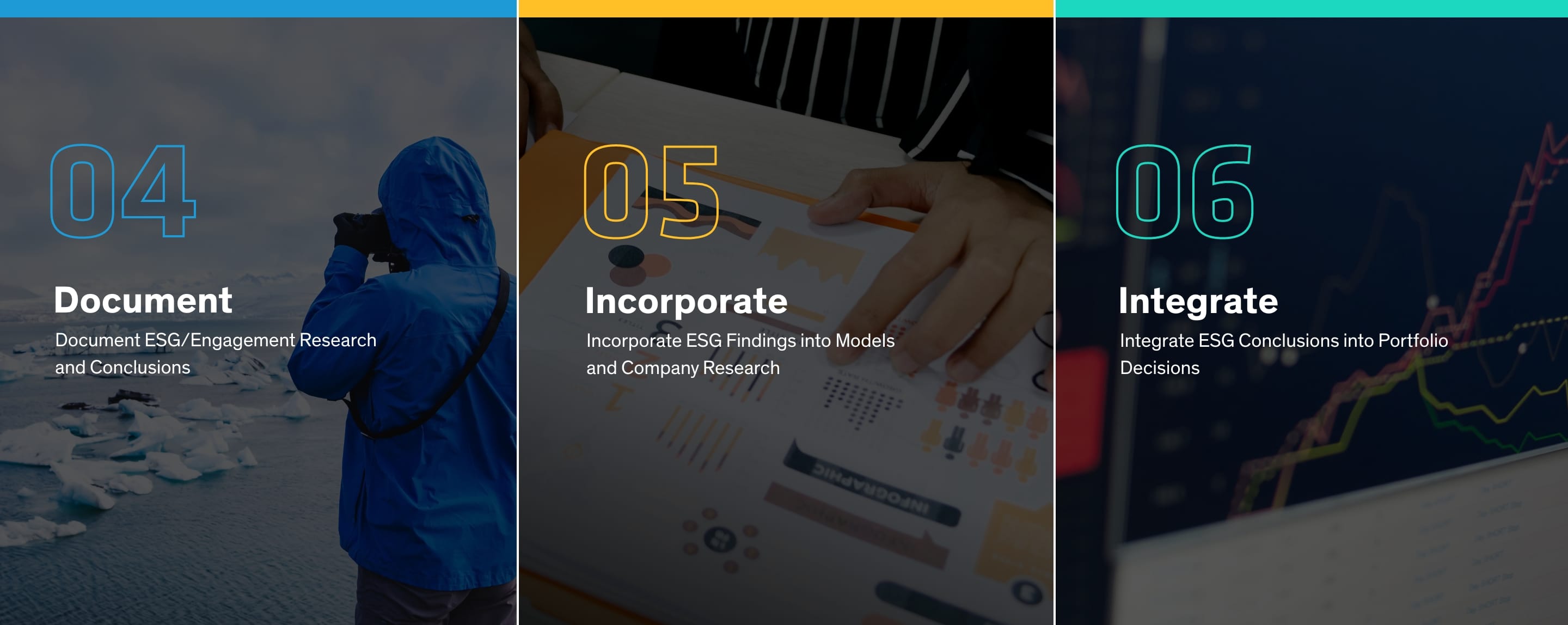

At AB, our Responsibility team helps portfolio managers and analysts consider and engage on material ESG risks and opportunities holistically and consistently, challenging investment teams’ thinking and encouraging analysts to incorporate this perspective into their financial models and outlooks. This robust approach helps teams consider material ESG risks and opportunities throughout their investment processes—ultimately driving better client outcomes.

Related Insights

Powerful forces are creating attractive opportunities in climate-focused companies for equity investors.

Investors are warming to opportunities stemming from climate change, and other takeaways from COP28.

Our Approach to ESG Integration

From idea generation to ongoing stewardship, integrating ESG involves considering material ESG risks and opportunities throughout the investment process.

Process in Action

Data points as of December 31, 2023

The Active Engagement Advantage

As active investors, engagement is important to our process. Each year, AB analysts engage with leaders of companies and noncorporate entities, including municipalities, supranational and sovereign issuers. We also engage selectively through our proxy-voting activities.

These connections allow us to assess, discuss and encourage better business practices and approaches to address rapidly evolving material ESG issues. We believe that engagement can drive better research and better outcomes for our clients.

How ESG Integration Can Improve Outcomes

ESG risks are often financial risks. With strong research, engagement and integration of material ESG issues, we can better assess risks and identify opportunities—the path to improved investment decision-making.

Climate Academy

AB and the Columbia Climate School are partnering to address the risks and opportunities related to climate change. Together, we hope to research the most pressing climate issues, embed those insights throughout our investment process where applicable and educate others.

Engagement in Action

- ENGAGEMENT IN ACTION

- COLLABORATIVE ENGAGEMENT

- ENGAGEMENT ESCALATION

The World Bank

The World Bank is an international financial institution that provides loans and grants to the governments of low- and middle-income countries to help fund capital projects. A project aimed to protect endangered black rhinos has garnered global attention. Black rhinos are a critically endangered species, and their population size reflects broader issues in biodiversity and conservation. Their endangerment is a good barometer of how these protected areas are faring.

Our objective in this engagement was to craft an ESG-labeled bond issued by the World Bank that achieves improved biodiversity in South Africa by targeting growth in the black rhino population. The challenge in this project was that the Global Environment Facility (GEF) wanted to incentivize black rhino population growth, while gamekeepers wanted certainty of cash flows to help build a rhino-protection team. We met with the World Bank and Credit Suisse numerous times throughout 2022 to arrive at a transaction that satisfied all parties.

AB ultimately helped craft a bond whose coupon would be tied to the GEF success criteria, including a Conservation Success Payment that bondholders would receive if the black rhino population continued to grow in line with recent trends. This structure allowed investors to address black rhino population risk while gamekeepers were assured of consistent payments. This is one of the first biodiversity outcome–based bonds in the market.

Petrobras

Petrobras is a major state-owned oil and gas producer in Brazil that has one of the largest corporate carbon footprints in Latin America. AB is an investor participant in the Petrobras Climate Action 100+ (CA100+) investor cohort and has held a series of engagements on the company’s climate strategy since joining the initiative.

During AB’s tenure on this engagement, Petrobras has continued to progress its climate strategy, despite persistent changes in top leadership and operating in the context of a dynamic political environment. In particular, in line with guidance provided by AB and the CA100+ investor cohort, Petrobras has recently made decisive new commitments around its climate activities. The company has now pledged to achieve net zero greenhouse gas (GHG) emissions by 2050.

In the most recent Petrobras engagement, the Environmental Defense Fund (EDF) joined AB and the investor cohort to provide perspective and expertise on managing risks related to methane emissions, which are major contributors to climate change, given that methane’s warming potential is much greater than that of CO2.

AB and the other investors encouraged Petrobras to join the Oil and Gas Methane Partnership 2.0 (OGMP). Launched by the United Nations Environment Programme and the Climate and Clean Air Coalition, the OGMP is a multi-stakeholder initiative that works with major oil and gas companies to help tackle methane emissions, which pose financially material risks and opportunities to issuers that we seek to manage on behalf of our clients.

By joining OGMP, members commit to disclosing according to the OGMP reporting framework, which works to improve the transparency and accuracy of methane emissions reporting. In previous dialogues, Petrobras expressed concerns over the technical feasibility of adhering to this reporting framework, attributing this concern to particular features of the company’s offshore drilling operations. However, AB and the investors were able to leverage the expertise of EDF to help address some of these concerns. Petrobras has since indicated that the prospect of joining OGMP membership is currently progressing through its internal approval processes.

AB and the CA100+ investor cohort are encouraged by the progress made on evolving the company’s climate strategy, as well as efforts to take investor priorities seriously.

Trupanion

Trupanion is a pet insurance company based in the US. We engaged with Trupanion management and board members multiple times throughout 2022. As part of these conversations, we’ve shared examples of what AB views as best practices, including our view that we expect board declassification in coming years. Although the company was not ready to immediately commit to the measure, management noted our concern and said they would discuss.

In November 2022, the CEO noted that he wanted to declassify the board during the time frame of his succession from CEO (current title) to chair/CEO (2023—2025) to chairman (2025 and beyond), asking our advice for best practices on this process.

We will continue to engage to monitor progress on board declassification.

How Does Engagement Make a Difference?

Collaborate, Explore, Advance

Proprietary Research Collaboration Platforms

We’ve innovated platforms that power collaboration between our analysts within and across asset classes as we research and engage with issuers.

PRISM

Our fixed-income ESG research platform, PRISM, provides independent ESG assessments and scores that affect investment decisions. The goal, of course, is straightforward: better and faster information can empower better decisions.

ESIGHT

ESIGHT is a one-stop online shop where AB investment teams can access and share proprietary information about corporate ESG practices. We’ve launched several ESIGHT enhancements, including an ESG knowledge center, COVID-19 research and country ESG scores for fixed income.

As of December 31, 2023.

Finding Responsible Solutions

Responsible investing is a personal journey. Clients may have different environmental and social priorities, and preferences for different investment approaches. To try to meet this need, we’ve developed our suite of Portfolios with Purpose—our ESG-focused strategies.

As of December 31, 2023.

Portfolios with Purpose

We manage US$28 billion in Portfolios with Purpose today, one of the most rapidly growing segments of our business. We also manage US$503 billion in assets that use ESG integration and other enhancements.

UN SDGS: A Road Map for Investors

In recent years, severe weather damage, the global pandemic, and political, economic, and social unrest have made ESG issues more tangible, fueling a global movement around taking responsibility for addressing these challenges.

Sustainable development involves finding solutions to these critical challenges. Directing capital to businesses providing solutions to these issues can provide investors with exposure to fast-growing industries that may help to preserve and, ultimately, increase their wealth.

The United Nations (UN) established the SDGs as a powerful framework of 17 goals to help countries address the challenges of economic prosperity, environmental sustainability and social inclusion. They represent an aspirational view of what the world can look like by 2030. We believe the UN SDGs can help investors connect the world’s crises with actionable investment themes, serving as a road map for translating sustainability issues into investible opportunities.

Based on this mind-set, we’ve developed a practical framework focused on four themes: climate, health, empowerment, as well as strong institutions for sovereigns.

Sustainable Themes

- CLIMATE

- HEALTH

- EMPOWERMENT

- STRONG INSTITUTIONS

Climate

Efforts to stem climate change are gaining momentum around the world. Many consumers, businesses and policymakers are recognizing the need for change.

- Cleaner energy

- Resource efficiency

- Sanitation and recycling

- Sustainable transportation

Health

Healthcare spending is rising, and people are living longer, which raises complex issues for access to high-quality and affordable medicine and long-term care.

- Access to quality care

- Food security and clean water

- Medical innovation

- Well-Being

Empowerment

Many sectors of society are marginalized by economic and social forces. Physical and technological infrastructure is needed to enable sustainable economic development, employment growth, poverty eradication and social inclusion.

- Education and employment services

- Financial security and inclusion

- Information and communication

- Sustainable infrastructure

Strong Institutions

Responsible sovereigns provide the foundation for the private sector to innovate and for effective and accountable public policymaking.

- Freedom and fundamental rights

- Anti-corruption and government

- Law and order

Featured Reports

2022 Responsibility Report

2023 Stewardship Report

2022 TCFD Report

Reports

- Reports, Policies and Statements

- PROXY VOTING

2023

2022

-

Global Stewardship Statement and 2022 Report

-

Global Slavery and Human Trafficking Statement and 2022 Report

-

Learn More

2022 Responsibility Report

-

PRI Transparency Report 2022

2024

2023

-

2023 US Proxy Season Review

-

Learn More

Significant & Escalation Votes and Rationales

-

2023 US Proxy Season Preview

As a registered investment advisor, AllianceBernstein L.P. ("AB", "we" or "us") has a fiduciary duty to act solely in the best interests of our clients. We recognize that this duty requires us to vote client securities in a timely manner and make voting decisions that are in the best interests of our clients. Consistent with these obligations, we will disclose our clients' voting records only to them and as required by mutual fund vote disclosure regulations. In addition, the proxy committees may, after careful consideration, choose to respond to surveys regarding past votes.

This statement is intended to comply with Rule 206(4)-6 of the Investment Advisers Act of 1940. It sets forth our policies and procedures for voting proxies for our discretionary investment advisory clients, including investment companies registered under the Investment Company Act of 1940. This statement applies to AB's investment groups investing on behalf of clients in both US and non-US securities.

Performance Tables

Shareholder Rights Directive II (SRD II) Disclosures

The SRD II aims to encourage long-term shareholder engagement and transparency between traded companies and investors. Asset managers and institutional investors can play a vital role in the responsible stewardship of assets.