Custom Muni Bond

Flexible Muni Solutions for Tax-Advantaged Outcomes

Connect with us!

Thank You

Thank you for contacting us. Expect a reply soon.

Investors should consider the investment objectives, risks, charges and expenses of the Fund/Portfolio carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, contact your financial representative. Please read the prospectus and/or summary prospectus carefully before investing.

There is no assurance that a separately managed account will achieve its investment objective. Separately managed accounts are subject to market risk, the market values of securities owned will fluctuate so that your investment, when redeemed, may be worth more or less than its original cost.

Tax Loss Harvesting (Tax Alpha) Disclosure: AB employs a tax loss harvesting program within its separately managed accounts. This may be achieved through screening for unrealized losses within portfolios and comparing the benefit of selling (tax benefit) relative to the cost of selling (estimated market transaction cost). ABs tax loss harvesting algorithm considers other factors as well such as tax drag on positions, considerations around replacement bonds and step-out custodial ticket charges if applicable.

The tax loss harvesting program is run based on Portfolio Management discretion. Whether the algorithm is run on a given day is dependent upon a number of factors including market liquidity conditions, portfolio cash levels, anticipated future active investment decisions within portfolios or strategies, among other considerations. While AB does anticipate regular tax loss harvesting via this program, AB does not guarantee a minimum frequency of tax harvesting within the program overall or an account specifically.

Should portfolio management deem it appropriate to run the tax loss harvesting program on a given day the algorithm recommends a list of suggested sales. These can be executed on a discretionary basis. AB has controls in place when executing trades to ensure the anticipated tax benefit evaluated by the algorithm is in-line with market executable levels; this is controlled via upper and lower limit prices on tax loss harvest sales. Market execution of a suggested tax loss sale is not guaranteed; intra-day market movement, changes in liquidity conditions, inability to execute within limits, trader discretion, among other factors may result in non-executed tax loss harvesting trades.

On an ongoing basis specific accounts are evaluated for eligibility to participate in the tax loss harvesting program. Specific accounts or positions may not be eligible for the tax loss harvesting program based on a number of factors. This includes missing cost basis data, availability of other evaluated data and decision analytics, portfolio positioning relative to portfolio management targets, account tradeable status based on position reconciliation or client directed freeze, among other factors.

Tax alpha, or the additional return generated from active tax management after-tax, will differ amongst strategies, portfolios and market environments.

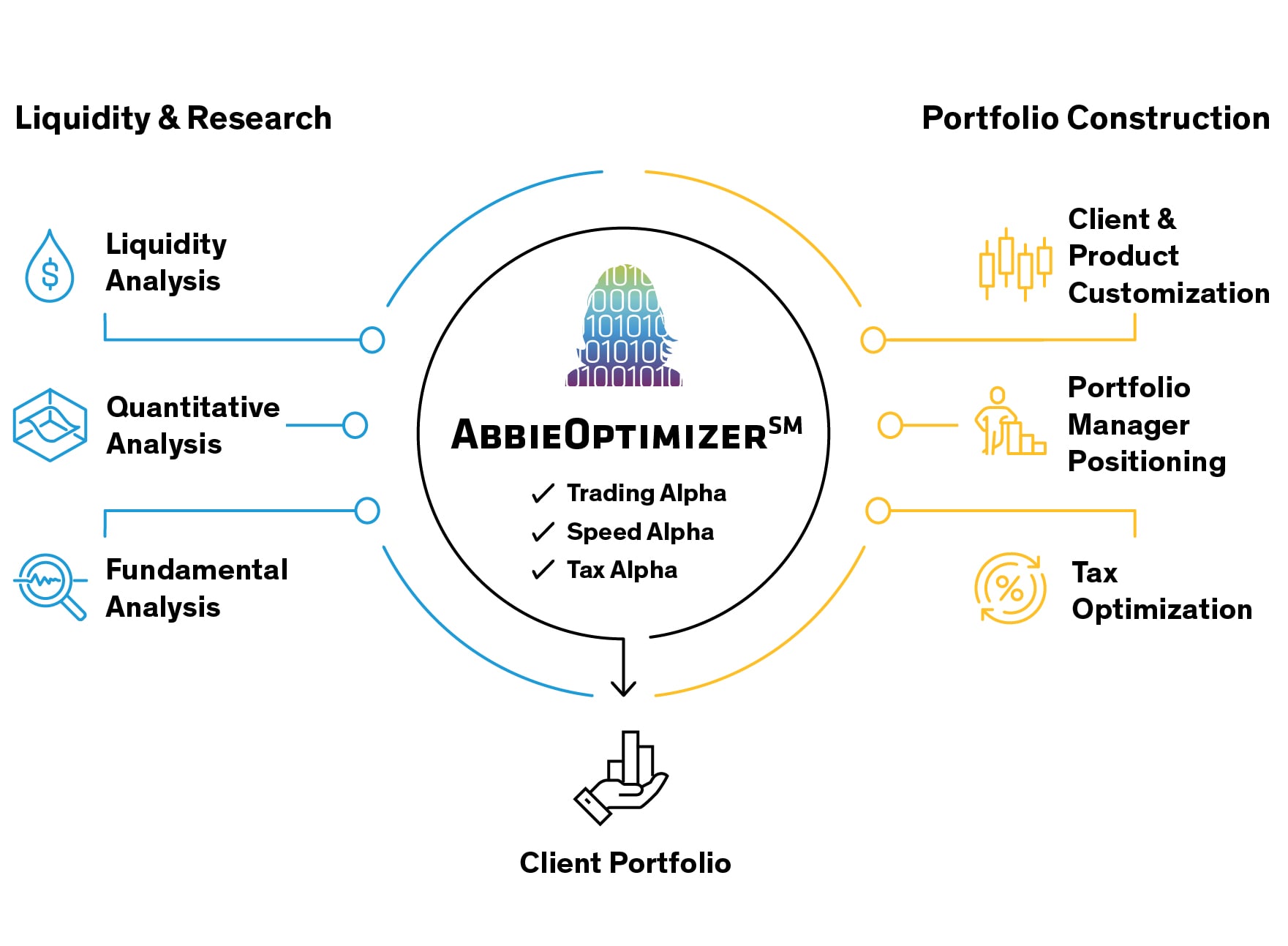

Speed Alpha Disclosure: AB utilizes technology to remove operational friction from the traditional fixed income SMA investment process. This can include direct integration of real-time bond liquidity and proprietary optimization of portfolios based on account customizations.

Through the automation of many traditionally manual aspects of fixed income SMA investing, AB may be able to fund portfolios more quickly than the typical industry average. AB measures this benefit by comparing AB investment time of a portfolio relative to an assumed industry average of 50 days. AB's process may result in a faster than typical funding time, generating additional income on a relative basis which we call "Speed Alpha”. We seek to utilize competitor yield proxies that are consistent with the client portfolio being analyzed. For example, intermediate duration strategies are compared against intermediate benchmarks. The competitor yield proxy will change based on the AB account strategy and the appropriate representative benchmark.

Note that actual funding times can and will vary based on portfolio management discretion, account strategy, portfolio size, market liquidity and technicals, among other factors. For example, a portfolio focusing on a particular specialty state may have a smaller liquid investable universe of bonds; this may result in longer funding times. In addition funding speed is ultimately at portfolio management discretion and there will be environments where investing more slowly is intentionally pursued.

There is no guarantee AB funding times will be faster than industry average or competitors, or that Speed Alpha will be generated. Additionally, Speed Alpha will vary amongst strategies, portfolios and market environments.

Trading Alpha Disclosure: AB utilizes technology to systematically screen for fixed income liquidity ingested into our proprietary optimization process. On average AB sees 50,000+ unique offers and bid-wanteds daily across a large variety of venues and liquidity providers.

The ability to aggregate fixed income liquidity within an optimization allows AB to quickly and efficiently curate attractive trade opportunities in a highly fragmented market. One attribute (among many) utilized in liquidity screening is offer price levels and identification of bid wanteds. This can include systematically curating liquid universes of bonds offered to AB at levels deemed cheap or attractive based on portfolio management discretion.

Our real-time liquidity screening process may allow AB to capture Trading Alpha on behalf of clients. Trading Alpha is measured as the difference between a 3rd party pricing service mark (end of day) relative to the executed AB price. This is tracked across all trades executed by AB.

There is no guarantee AB execution will result in Trading Alpha. Additionally, Trading Alpha will vary amongst strategies, portfolios and market environments.