At a time when US defined contribution plans are seeking to control risk and enhance returns, hedged global bonds can improve outcomes for participants and sponsors. But how do plans incorporate global bonds in core menus and target-date funds?

Adding Global Bonds to the Core Menu

When it comes to the core menu, multimanager design—a growing trend that’s making its way into midsize and smaller plans—can be the key to going global. Many smaller plan sponsors now have the ability to add a global bond offering as a complement to their US bond offering, and to guide participants toward increased allocations to it.

Even better, larger plan sponsors have the flexibility to incorporate global bonds directly into their core bond option. This allows plan sponsors to design their core bond option to better meet participants’ risk and return objectives without creating disruption for participants.

The Target-Date Solution

Within target-date funds (TDFs), whether we’re looking at customized TDFs for larger plans or packaged solutions for smaller plans, our research shows that having a bond allocation that is not US-centric can improve the glide path.

As with the core menu option, the diversifying and risk-mitigating effect that we expect from a bond allocation can be enhanced through the addition of global bonds.

Better Risk Mitigation Makes a Big Difference

Our research indicates that hedged global bonds have been a better risk mitigator versus equities than US bonds have been, especially during months when equity returns were more than one standard deviation below their norm.

The concept of risk mitigation is as central to our study of glide paths as the opportunity to add value, whose cumulative effect is widely appreciated. (A global bond allocation also provides an active manager with significantly more opportunities to add value compared with US bonds.)

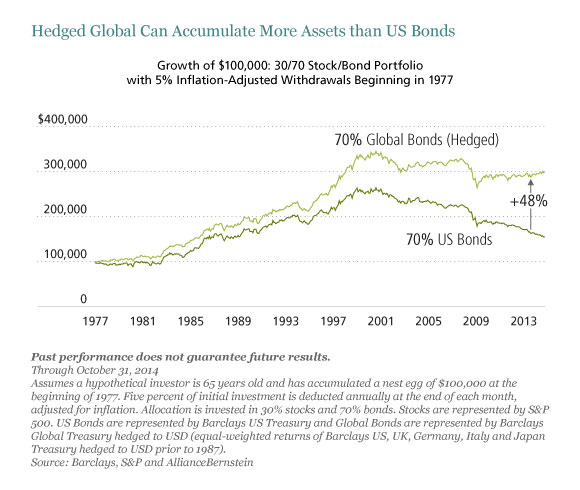

In the Display below, we’ve modeled the spending phase of a retiree since 1977. This individual began with $100,000 and has been taking an inflation-adjusted withdrawal of 5.0% annually. The dark-green line illustrates the growth of a portfolio in which the 70% portion of the 30/70 stock/bond allocation is invested in US core bonds.

The light-green line shows the growth pattern of a portfolio in which the 70% portion is invested in hedged global bonds. This portfolio benefited from better risk mitigation during the inflationary environment of the late 1970s and early 1980s, as well as during the crash of 1987.

The result over the full period? A 48% greater asset accumulation versus the US-only allocation.

And when we bumped our withdrawal rate up by just half a percentage point to 5.5%, the US core bond portfolio ran out of money prematurely. It’s clear that the decision to shift at least part of the assets into global is critically important. By mitigating risk drag more effectively, the retiree may add years of spending.

How Much to Allocate in a TDF

How much do we advise allocating to hedged global in a TDF? We find that a minimum of 50% of the total bond allocation is attractive. At less than 50%, meeting investor objectives becomes more challenging and less certain; at 50% and above, we preserve purchasing power, avoid sharp market declines and minimize risk of loss.

So go global in your core menu or target-date fund. Tap into the potential power of diversification and risk mitigation. Open a broader opportunity set to active managers. But be sure to align with your investor objective by hedging the currency risk.

“Target date” in a fund’s name refers to the approximate year when a participant expects to retire and begin withdrawing from his or her account. Target-date funds gradually adjust their asset allocation, lowering risk as participants near retirement. Investments in target-date funds are not guaranteed against loss of principal at any time, and account values can be more or less than the original amount invested—including at the time of the fund’s target date. Also, investing in target-date funds does not guarantee sufficient income in retirement.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Portions of this article have previously appeared on AllianceBernstein’s blog, Context.