“If you build it…” will they come? DC plan sponsors can take heart that automatically enrolling participants in QDIAs, like target-date funds, is a move that most workers will welcome.

We’ve all experienced the confusion that happens when we’re outside our comfort zone. Making investment-related defined contribution (DC) plan decisions is definitely outside the comfort zone for many Americans.

Many Participants Have a Low Score on Financial Literacy

Our latest survey reveals a lot of the confusion many participants face when making DC plan decisions. The survey also uncovered a significant amount of misinformation that Americans have about investing for retirement—noticeably with their understanding of target-date funds, which are the most widely used qualified default investment alternatives (QDIAs) among DC plans.

Understanding of Target-Date Funds Is Low, Too

Nearly two-thirds of our respondents either incorrectly thought target-date funds were FDIC-insured or didn’t know if they were or not. Yet there are essentially no capital-market investments that have that guarantee.

We uncovered misinformation about target-date funds even among target-date users. Despite the fact that target-date funds are all-in-one, fully diversified solutions, many participants place less than 80% of their DC assets into their target-date fund. Certainly, that might be because they also invest in company stock, for example. But the most often cited answer was that “I don’t want to put all of my eggs in one basket.”

Automatic Enrollment Overcomes the Knowledge Gap

With this unfortunate amount of misinformation, it’s no wonder that some plan sponsors hesitate to fully implement target-date funds into their DC plans with a plan reenrollment. That’s when all existing participants are notified that their investments will be mapped to the plan’s QDIA (usually a target-date fund) on a certain date, unless they make a new investment election prior to that date.

Plan sponsors may question whether such a reenrollment might ruffle some feathers among participants. But we have good news for plan sponsors: plan participants are much more comfortable with being automatically enrolled into target-date funds than you might think.

First, it’s worth noting that more than a third of our respondents who don’t invest in target-date funds said their plan doesn’t offer it, but if it were offered, 57% said they’d use the target-date fund.

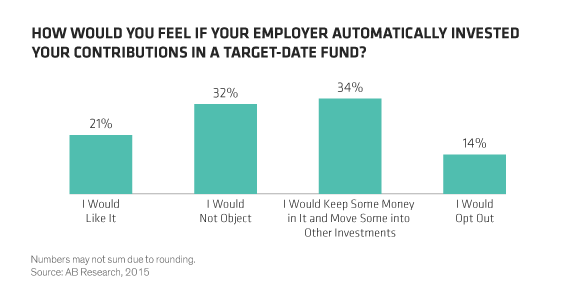

Next, we asked plan participants how they would feel if their employer automatically invested their contributions in a target-date fund (Display). An overwhelming 87% would stick with the target-date fund—for either all or part of their contributions. Only 14% said they would opt out. And while inertia is often cited as a telling ingredient in the stickiness of automatic enrollment, there’s no inertia in play when answering a survey.

And if plan sponsors were to add a guaranteed income component by incorporating an insurance feature into a target-date fund, then people would get really excited. Not only is automatic enrollment into a guaranteed income target-date fund viewed equally favorably by current plan participants, our survey found that it actually increased levels of enthusiasm by nonparticipants for joining the plan.

From all this, we believe the vast majority of employees would give plan sponsors the green light to automatically help them save better for retirement—and alleviate a lot of confusion from this non-comfort-zone necessity.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

"Target date" in a fund's name refers to the approximate year when a plan participant expects to retire and begin withdrawing from his or her account. Target-date funds gradually adjust their asset allocation, lowering risk as a participant nears retirement. Investments in target-date funds are not guaranteed against loss of principal at any time, and account values can be more or less than the original amount invested—including at the time of the fund's target date. Also, investing in target-date funds does not guarantee sufficient income in retirement.