When investors ask if an asset is liquid, what they usually want to know is: will they be able to get rid of it quickly, either to realize a profit or avoid a loss? But liquidity isn’t constant. It depends on many factors, from investor sentiment and behavior to market structure and conditions. And over the last few years, changes in all of these elements have combined to drain liquidity from the global bond market.

Stricter regulations have prompted banks to reduce their role as active buyers and sellers of corporate bonds. Central banks’ easy money policies have driven government bond yields to record lows and pushed investors to crowd into the same risky trades. And large institutional investors are increasingly relying on risk-management strategies that use leverage and may cause investors to act the same way at the same time. This increases the risk of correlated moves across assets.

On their own, none of these trends is likely to trigger a major market crisis. But taken together, they’re creating a lot of dry tinder. And the next shock to hit markets might be the spark that sets everything ablaze. With fixed-income volatility rising, investors can’t afford to take this risk lightly.

Fortunately, there are ways to manage liquidity risk. Investors that do it well may even find bargains, especially if they have large balance sheets and long investment horizons. In this research, we examine what investors can do to protect their portfolios. We also look at what they should expect of their asset managers. After all, managers who don’t see the big picture with liquidity probably won’t be able to keep their clients out of the liquidity trap.

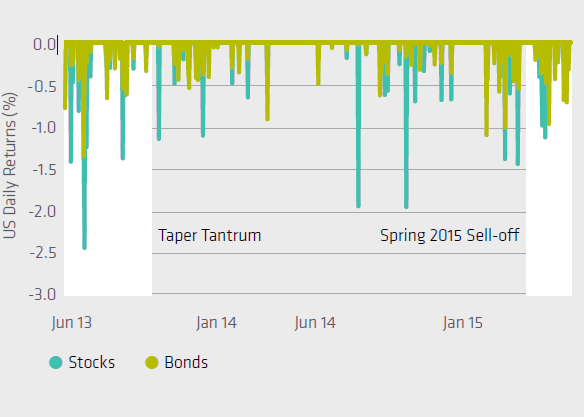

Correlated Sell-offs Becoming More Common

Trading Days When US Stock and Bond Returns Were Both Negative