As more corporate bond issuers in China run into financial trouble, investor anxiety about the possibility of a broader market collapse has understandably increased. We don’t think it’s time to man the lifeboats, however; on the contrary, we believe that Chinese bonds still offer good opportunities for research-driven investors.

The list of financial casualties in China’s corporate bond markets is growing. Earlier this month, coal importer Winsway became the second company this year to default on a US-dollar bond, following in the footsteps of property developer Kaisa, which defaulted in April.

Also this month, bonds issued by Beijing-based water treatment company Sound Global slumped when it announced that auditors had discovered a cash shortfall. Underground mall developer Rehne bought back its dollar notes at a discount in what was described as a distressed exchange.

Defaults Are Not Unusual

Against the background of the continued slowdown in China’s growth and the government’s difficult policy balancing act—allowing growth to slow, but not too much, so that it can implement reforms—these developments may seem ominous. In our view, however, they don’t obviously point to a broad market collapse.

They can be seen as consistent with the fact that Asia in general and China in particular are in the late stage of the credit cycle. This has been reflected in the Asian high-yield credit markets, which have experienced increased volatility during the last five years. In this environment, corporate defaults are not unusual.

The change in spreads means that high-yield corporate bonds have become less attractive to investors than less risky investments, and that financing costs for high-yield issuers have increased.

Demand Is Strong, But Different

Another reason we don’t expect a broad collapse is that our research continually uncovers pockets of strength as well as weakness in industry sectors that borrow in China’s bond markets. Many investors, for example, regard the country’s property sector as high-risk, and it’s true that certain parts of the industry are experiencing real difficulty.

Recently, we again visited the mainland to investigate the sector. Our findings from earlier visits were largely reaffirmed. For example, risk is not even across the sector: the commercial real-estate sector is in much worse shape than its residential counterpart.

Within the residential sector, the risks are nuanced. We visited two Tier 2 cities (Chongqing and Zhengzhou) and one Tier 3 city (Foshan) at a good time to assess the impact of supportive policy measures recently introduced by the government, such as a reduction in mortgage down payments and an interest-rate cut at the end of March.

We confirmed our view that the national property market has peaked and that the pattern of supply and demand is diverging further and more quickly between different cities, districts and projects.

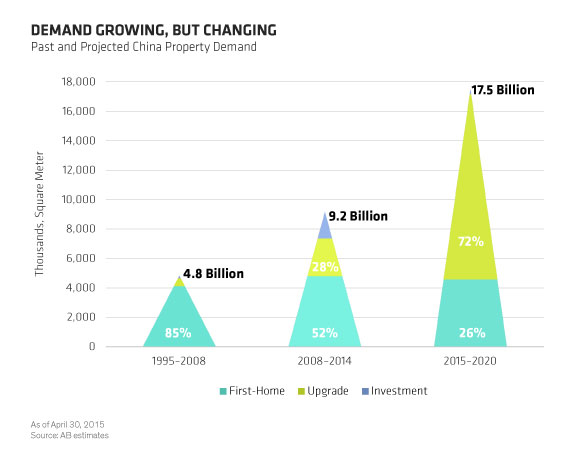

While this represents challenges for residential developers, it offers opportunities too. Encouragingly, we found that demand continues to grow strongly; it has, however, changed in nature: for the first time, upgrades accounted for a greater share of demand than investment or first-home purchases (Display).

While the strong underlying growth in residential property demand provides an opportunity for developers, the changing nature of demand poses a challenge. We believe, however, that certain developers can still enjoy decent earnings growth, improve their liquidity position and strengthen their credit profiles over the medium term—providing they position themselves in the right cities with an appropriate mix of products and rational strategies for construction and land acquisition.

Careful Approach Needed

On this basis, we don’t accept the view that the Chinese property sector as a whole is on the brink of collapse. We see similarly variegated pockets of strength and weakness in other sectors. This suggests that, while more corporate defaults and market volatility are still likely in China, investment opportunities will continue to be found by those who do the necessary hard work to find them.

China is not so much a market to shy away from as to approach carefully, and one of the best ways of doing this is to acquire exposure through a well-diversified portfolio of securities backed by sound research, rather than buying individual securities outright.

As the Asian credit cycle moves further through its late stage, the idiosyncratic risk that caused defaults will increase. In light of this, we think it’s wise to focus less on the high-yield credit market and more on investment-grade credit, especially shorter-term paper. One- year maturity Dim Sum bonds appear to be very attractive: in a world where cash rates are at or close to zero, investment-grade Dim Sum bank paper yields around 4% for one year’s duration risk.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.